Our Services

Experience counts.

Hard work pays.

Investor Relations

We enable clients to grasp and command the relevant perceptions of the investment community through a constant loop of cooperation, communication, and feedback. This allows us to key in to your specific business and industry needs and create tailored, compelling investment messages. We cover all critical issues pertaining to capital markets, including raising capital and mergers & acquisitions. We use valuation analysis and peer group positioning to gain insightful data, which we ply in your business through investment community speech and media training. We are trained, prepared, and equipped to handle any and all crisis communication that may arise.

Investment Community Outreach

Our investor relations programs provide your business with a highly targeted outreach program, guaranteed to connect your business to the right people at the right time. We use proprietary and subscription databases to reach receptive investment community constituencies, accounting for peer group, company size, and investor-specific qualifications. We guarantee a representative presence for your company at investor roadshows, analyst days, annual shareholders’ meetings, and investment bank investor conferences. We’ll use conference calls/webcasts, investment community perception studies, contact list management, investor information requests, podcasting events, and an array of other digital strategies to secure, maintain, and strengthen your investor relations and outreach.

Corporate Governance & Regulatory Advice

We’ll insure you’re using best practices for small companies and utilizing accelerated filers. We have a Regular Full Disclosure policy, and offer safe harbor consultation to guide you through financial results issues, proxy, and a multiplicity of shareholder issues. We do IPO and pre-IPO preparation and consultation work, including spin-offs and care-outs. We also perform exchange listing selection and stock splits.

Collateral Material Development

We offer both an initial creation and ongoing adaptation of investment appeals. We use expertly crafted press releases, fact sheets, investor slideshows, proprietary analyst research reports, and other shareholder materials to communicate your businesses’ upward trajectory to investors. We also employ conference calls, speech writing, and the IR section of your website to empower your appeals.

Corporate Communications & Messaging

Communication is key, and we ensure yours is top-notch through internal strategy development that covers a holistic approach to corporate communication. Our method refines your correspondence, web site content, community relations, public affairs and other collateral materials with leadership training, corporate branding, and corporate advertising.

Media Outreach & PR Campaign Strategy

Our media contacts and strategies will ensure your business gets the right message out to the proper channels, including broadcast, print, and digital. We’ll manage your media relationships with a versatile tool belt of strategies, like ghost writing, white paper proliferation, and podcasting events. Furthermore, we’ll build your reputation and representation at key media tours, roadshows, and trade shows.

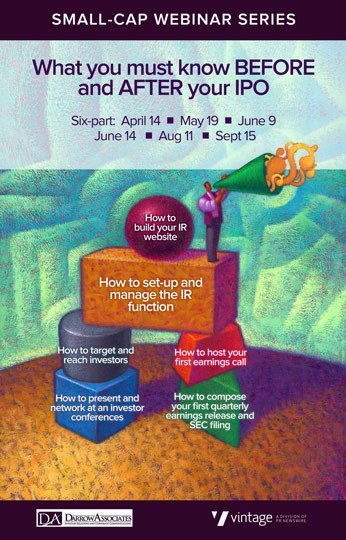

IPO Advisory

As IPO Advisors, we are proven experts at walking our clients through successful IPO campaigns time and time again. This is because of our commitment to thoroughly prepare and guide them through every step of this crucially important process. We work with our clients to set strategic goals and benchmarks Pre-IPO, Post-IPO, and beyond across an array of business sectors. Additionally, we also help clients whose IPO process did not turn out successfully, and are looking to improve their valuation and performance.

IPO Advisory Services

Pre-IPO Services

Strategies and activities to support our clients pre-IPO

Pre-Filing

- Assist with vendor selection

- Consolidate and distribute peer and industry research

- Recommend guidance metrics to use in releases/scripts

- Facilitate sell-side relationships

- Create investor database

- Confirm IR communications protocols

Post-Filing / Roadshow

- Participate in roadshow rehearsal and Q&A

- Focus on message development

- Develop 12 month calendar of events

- Establish IR logistics

- Draft and finalize IR website

- Counsel on initial IR related items

Pricing / Post-IPO

- Solicit roadshow feedback; use data for forward communications

- Counsel company on all IR related issues

- Monitor peer and industry news

- Maintain sell-side model

- Analyze and deliver quarterly ownership report

- Serve as first point of contact for retail investors

Post-IPO Services

Strategies and activities to support our clients post-IPO

Earnings

- Draft all earnings related documents

- Poll sell-side for questions/concerns

- Q&A preparation

- Review peer earnings results

- Summarize peer sell-side research

- Manage earnings call and press release logistics

- Conduct follow up and report findings

Outreach

- Actively participate in sell-side relationships

- Establish first point of contact for investors

- Continuous buy-side targeting and outreach

- Manage investor presentation

- Target investor conferences with firms not covering

Support

- Counsel company on all IR related issues

- Counsel management on Reg. FD disclosure issues

- Monitor peer and industry news

- Maintain sell-side model

- Analyze and deliver quarterly ownership report

- Serve as first point of contact for retail investors

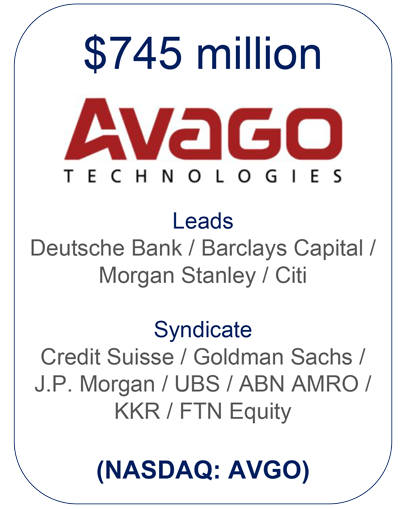

Representative Technology IPO Experience

Pre-IPO Activities

- Built first investor relations program after spinout from Agilent in 2005

- Created entire IR infrastructure

- Initially managed relations with bond analysts, investors and ratings agencies

- Secured investor conference speaking opportunities

- Managed all aspects of quarterly reporting

IPO Related Activities

- Created targeting matrix to identify appropriate sell-side analysts and investors

- Assisted banks with IPO roadshow investor targeting

- On team that developed roadshow content

- Managed vendor relations for new IR website

- Drafted and issued appropriate IPO related material

Representative Post-IPO Experience

IPO – First Year

- Hired after IPO “busted” – trading below the offering price for period of time

- Winner of the prestigious “Creativity in Public Relations Awards” (CIPRA) competition for the “Best Investor Relations Program for an Initial Public Offering”

Full Term Of Service / Relevant Achievements

- Outreach initiatives included implementation of a national non-deal road show over a 2 year period until stock price stabilized and shareholder base transitioned from IPO

- Missionary & maintenance activities thereafter

IPO bankers abandoned stock; we brought in new bankers and new analyst coverage - Represented company for over six years

- A long term client/consultant relationship until acquired