What Our Clients Say About Us…

I couldn’t speak more highly of Chris. After deciding what we could afford as a retainer Chris accepted and went to work. He is a complete self-starter, no need to make sure he’s working for you. Because he’s based in NYC and does this for a living he’s extremely well connected with small/micro cap investors. Chris operated seamlessly as if he was an in-house employee often working directly with the staff – scheduling conferences and road shows, writing press releases and scripts, website updates, etc. Chris gave us much more than our previous in-house person at a price we could afford.

Darrow Associates proved time and time again that it offers a unique sophistication, focused strategic thinking and an impressive network of financial community contacts to support its clients. And, as well, truly understands the prime focus that must always, always be on strategic redistribution of the client’s shares as an absolute, particularly since the disappearance of the retail/boutique broker dealer.

What The Investment Community Says About Us…

Having been on the research and banking sides for many years, I can tell from the way you know your clients so well that Darrow Associates is on a different level than many other IR firms.

You do an amazing job, best I have seen for a small cap company.

Peter has done an exceptional job in my opinion of presenting MNTX as an outsourced IR. I feel like he is part of the company.

Jordan: Thank you for the opportunity. You personally have been a great asset and help to Lakeland. You have provided the investment community with detailed press releases that allowed people the opportunity to understand the organization’s complicated financial reports. I am grateful to you personally and professionally. You have helped me improve my skills. I am hopeful that others will recognize your effort and hire your firm to assist them. You deserve it!

Select Darrow Associates Client Case Studies

We work with clients from a variety of verticals in industries where we have experience and can get the results our clients are looking for. This is an abridged overview of the clients and sectors we serve, not an exhaustive list of our clients or the verticals and industries that we cover.

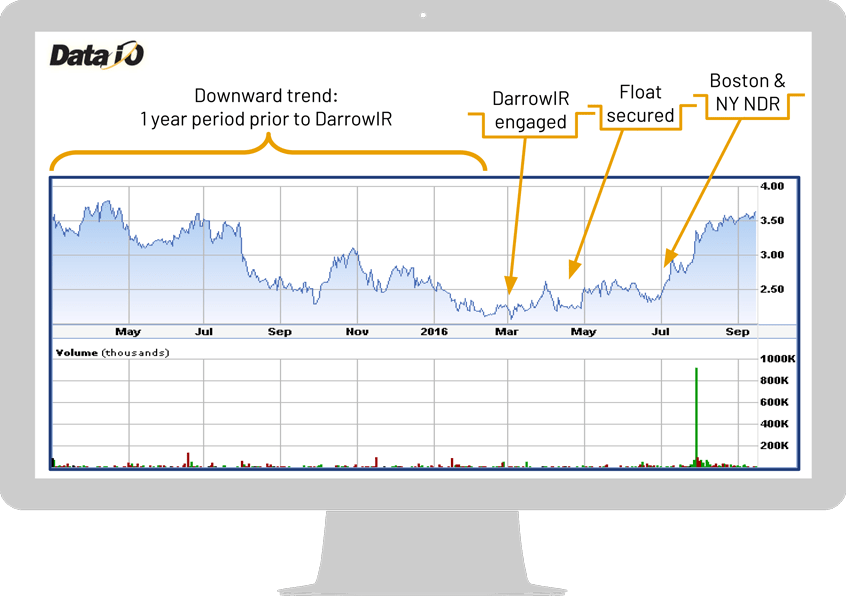

Case Study: Data I/O Corp (DAIO)

Part 1

- Over a year with no meaningful IR progress despite engaging professional IR firm

- Darrow Associates brought in at suggestion of largest shareholder

- Deep dive on company issues: circled wagons with management and key owners

- Developed IR program: press release strategy; collateral material; roadshow and conference schedule; investor outreach strategy

- Program commenced 3/1/16; 3 Boston fund managers begin buying shares on/about 7/8/16

Case Study: Data I/O Corp (DAIO)

Part 2

Darrow Associates continued to increase the share prices and volume for this client. The two graphs shows this continual rise from inception of IR program (March 2016) through Mid-May 2017.

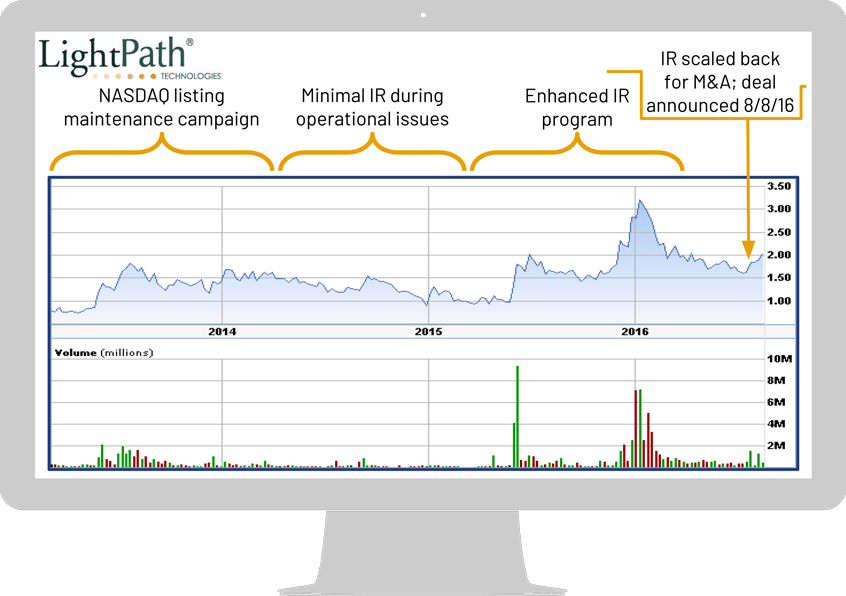

Case Study: LightPath Technologies (LPTH)

Part 1

- Engaged for Nasdaq listing maintenance campaign with stock below $1.00

- Program scaled back so management could focus/invest in operational issues

- New phase of IR program implemented — combining comprehensive approach using press releases, continued outreach and conferences/NDRs

- Urged management to seek acquisitions to supplement growth; assisted in development of M&A criteria and engaging investment bank for support

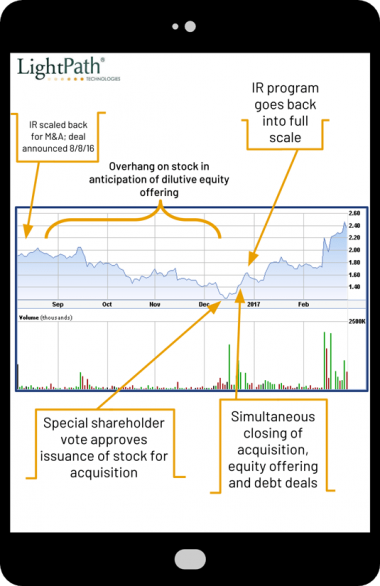

Case Study: LightPath Technologies (LPTH)

Part 2

Darrow Associates worked closely with this client through their listing maintenance program, revised IR strategies, and corporate strategy development. The IR program utilized M&A and Capital Markets Initiatives

Select Client Representation

We work with clients from a variety of verticals in industries where we have experience and can get the results our clients are looking for. This is an overview of the historical and current clients and sectors we serve, and is not intended to represent a list of only our current client base.

Semiconductors

Optics / Telecom

Software & Cloud-Based Services

Network Infrastructure

Semiconductors